top of page

All Posts

Small Business and Tax Season: Turning Stress into Strategy

For small business owners, tax season can feel like an annual storm, inevitable, intense, and often disruptive. Between running day-to-day operations, managing customers, and planning for growth, carving out time for taxes isn’t easy. But with the right mindset and preparation, tax season can become less about stress and more about strategy. Why Tax Season Hits Small Businesses Harder Unlike large corporations with in-house accounting teams, small businesses often rely on a s

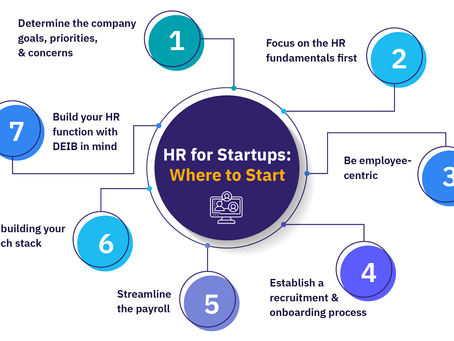

HR in 2026: How Startups and Small Businesses Can Build Cultures That Grow

As startups and small businesses look ahead to 2026, HR is no longer just paperwork and payroll; it’s a powerful driver of growth, culture, and long-term success. From evolving employment laws to competitive hiring markets and rising employee expectations, the right HR strategy helps small businesses stay compliant, attract great talent, and build workplaces where people actually want to stay. For growing organizations, HR decisions made today directly impact risk, retention,

Oregon Employee Tax Compliance Updates for 2025–2026: What Employers Need to Know

As Oregon rolls out significant tax and payroll compliance changes for 2025 and 2026, employers—especially those in construction, contracting, and professional employer organizations (PEOs)—must prepare now to stay compliant. New laws, updated withholding rules, expanded transparency requirements, and tax‑compliance certification mandates will impact onboarding, payroll processing, and state-level licensing. Key Oregon Payroll & Employee Tax Compliance Changes for 2025–2026 1

From Startup to Success: Why Quality Onboarding Fuels Sustainable Growth

For startups and mid-sized businesses, every new hire matters. The early stages of growth are exciting but demanding — and the people you...

Team Building Training: An HR Trainer’s Guide to Building Stronger Teams

In today’s workplace, teamwork is the engine that drives success. Organizations with strong team-building strategies see higher...

bottom of page